Navigating the Three Main Changes to Part IX of the UK Drug Tariff – Implications and Strategic Responses for Medtech Manufacturers

In 2025, changes to Part IX of the NHS Drug Tariff, specific to medical devices, were implemented in England and Wales following a 2023–2024 UK government consultation on the prescribing of medical devices in primary care. In this article, Michelle James (Consultant – Global Pricing and Market Access, Petauri Evidence) discusses three key changes to the Drug Tariff and what impact these have for manufacturers and suppliers of medical devices aiming to gain access to the NHS in England and Wales.

What is Part IX of the Drug Tariff?

Part IX of the Drug Tariff refers to the list of approved medical drugs and appliances (i.e. medical devices) that are permitted to be prescribed in primary care, at NHS expense, by an appropriate healthcare practitioner (HCP). It also outlines the prices at which these drugs and appliances can be reimbursed.

The 2025 reforms, which are particularly important for medical devices, build upon the previous general criteria, which stated that all products included in Part IX must be safe, of good quality, appropriate for prescribing by HCPs, and cost effective. The reforms also reflect part of a broader portfolio of work within the UK government’s Medtech Strategy. These reforms aim to improve the assessment of, and access to, innovative Medtech products in a more timely and evidence-driven manner. This includes the introduction of NICE’s HealthTech Programme earlier this year – read more about this here.

The intention is that updates to the Drug Tariff will improve current standards, ensure continued value, and incorporate the patient and clinician’s perspective into the listing process. The three main changes to Part IX of the Drug Tariff (the Tariff) are outlined below.

Change 1: Enhanced Assessment Criteria for Product Listing and Reassessment

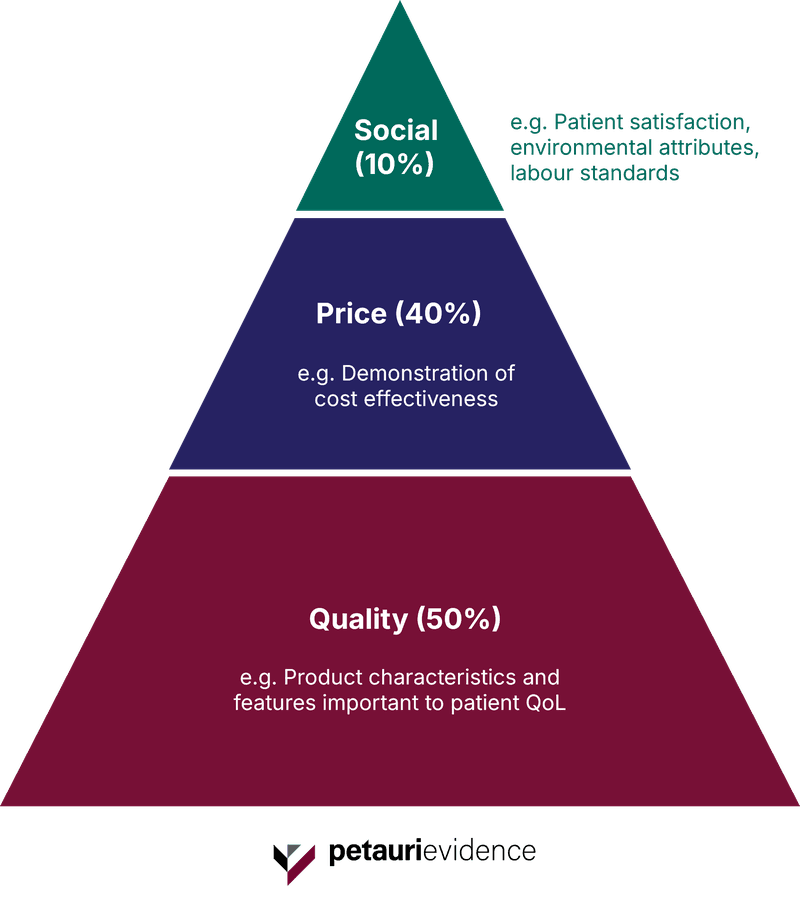

The new listing process introduces a weighted evaluation methodology, considering factors such as quality, price, and social value (Figure 1).

For companies seeking inclusion or renewal, this means greater scrutiny, particularly around demonstrating cost effectiveness as well as clinical or patient benefit compared with existing medical devices. Smaller Medtech companies, with fewer resources to undertake additional clinical trials, may struggle to obtain or present such evidence.

Similarly, older products may be required to obtain further evidence, in addition to any existing clinical data, to meet the new evaluation standards and to justify their continued listing.

In addition, the new process requires further perspectives from patients and HCPs as part of an independent advisory panel. The inclusion of the patient and clinician voice may present a challenge, particularly where health-related quality of life data are not evident and/or there is a lack of strong advocacy by either stakeholder group.

Advisory panels included during evaluation will not include representation from suppliers/manufacturers, which reduces the opportunity for suppliers/manufacturers to discuss any objections or concerns during evaluation.

Change 2: Introduction of a Renewal Process and Increased Number of Product Categories

Before the recent updates, products were listed on an indefinite basis unless there was a significant risk to patient safety. The previous tariff was also grouped into a limited number of categories based on physical attributes – resulting in an increasingly complex, out-of-date, and cost-ineffective catalogue of available products.

To overcome this, recent changes to the Tariff have resulted in more definitive categories based on added clinical value and cost benefit. In addition, there is now greater alignment with decision-making processes made under other Medtech evaluation routes such as NICE’s HealthTech Programme. Products are also subject to re-evaluation every 4–5 years, with those that have not been prescribed in the last 24 months facing potential removal or invitation to apply for re-listing.

These changes are expected to provide prescribers and patients with up-to-date, peer-led information to make informed clinical choices, as well as reducing heterogeneity across patient access to medical devices within the NHS.

For manufacturers, these changes as well as those made to the evaluation process (as outlined in Change 1 above) are expected to result in increased scrutiny and rigorous product comparisons as companies shift to meet newer evidence requirements. The impact on companies is expected to manifest in a number of ways, from operational, compliance, and competitive perspectives, including:

- Increased administrative burden in preparing for the renewal process

- Greater risk of reduction in a product’s price potential as historical listings in the same category lower their prices to compete with newer products

- Diminished supplier diversity and competition as products risk potential of delisting altogether if criteria are not met

Change 3: Creation of a Temporary Listing Route for Certain Qualifying Products

In a strategic shift to align with the Early Value Assessment route offered via the NICE HealthTech Programme, additional updates have been made in the form of a temporary listing route. This has been created to enable temporary access to the England and Wales market via Part IX of the Drug Tariff. Those that are listed are granted access for 12 months before reassessment to remain on the Part IX Drug Tariff.

Through this route, manufacturers can obtain temporary access to these markets for their new products despite the absence of a robust evidence base. This is particularly useful for suppliers of innovative Medtech devices that are significantly different to existing products and are unlikely to have sufficient evidence generated within the NHS. This will also benefit smaller companies that lack the resources and budget to conduct appropriate evidence generation, giving them time to gather the necessary data to demonstrate added healthcare benefit.

This new temporary listing process will expedite patient access to innovative products, bringing potentially live-saving treatments to market sooner than traditional routes.

Recommendations to mitigate risk and how Petauri Evidence can support

Following these main changes to Part IX of the Drug Tariff, manufacturers and suppliers of medical devices may wish to carefully consider their strategic approach to market access within the UK. This may include:

Evidence Generation:

- Consider the current evidence package and potential need to develop robust clinical and health economic evidence to support access under the new Part IX framework

- Prepare for the enhanced assessment scoring methodology used (quality, price, social value)

Pricing Strategy:

- Consider benchmarking price against comparable products

- Consider value-based pricing models to support with cost-effectiveness demonstration

Portfolio Management:

- For existing manufacturers and suppliers of products, audit current listings and prepare for any renewal cycles

- Identify products at risk and prioritise strategic support

Petauri Evidence can help with strategic planning for renewal and new listing applications, evidence generation and dossier development, and pricing and reimbursement strategies tailored to NHS frameworks. To discuss your strategy, email evidence@petauri.com.

Share