How to Write AMCP Dossiers that Truly Support US Payers: Six Tips Informed by 2025 Payer Insights

AMCP dossiers remain a cornerstone of US payer decision making, but as the healthcare landscape evolves, so do payer expectations. To help manufacturers navigate this complexity, Sophie Streeton (Associate Director – Global Market Access, Petauri Evidence) has compiled six actionable recommendations based on insights from our 2025 Petauri Payer Panel Insights Survey.

These tips are designed to help you craft dossiers that resonate with payer audiences, support informed decision making, and accelerate access.

For those unfamiliar with Academy of Managed Care Pharmacy (AMCP) dossiers: these are standardized evidence packages used by US healthcare decision makers to evaluate new drugs and devices. Developed by the AMCP, the format helps manufacturers present clinical, economic, and other relevant data in a way that supports decisions around formulary inclusion, coverage, and reimbursement.

Here are six actionable recommendations for your next AMCP dossier:

1. Keep your Dossier Concise, and Convey a Clear Value Proposition

Why it matters:

In our survey, payers consistently emphasized the importance of brevity, transparency, and a clear value proposition.

The evidence:

When asked about the factors that make an AMCP dossier high quality, 89% cited transparency, 78% brevity, and 77% a clear value story as top factors for dossier quality.

We also asked about the most common limitations or shortcomings of AMCP dossiers. Here, 72% said dossiers are often too long, while 56% cited lack of a clear value story.

While it’s essential to include robust clinical, economic, and real-world evidence, overly lengthy or unfocused dossiers can hinder usability. As payers typically use manufacturer-provided dossiers to develop their own internal dossiers, it is critical that they can easily locate evidence of interest within the document.

Top tip:

Avoid overwhelming detail. Use summaries, bullet points, and structured formatting to help payers quickly extract what they need. Think of the dossier as a reference tool, not a narrative report.

“To be impactful, the AMCP dossier should be short, concise, and provide clinical evidence from the published, peer-reviewed literature.” – US payer in our 2025 survey

2. Make Dossier Navigation Effortless

Why it matters:

Payers rarely read dossiers cover to cover. Instead, they use them as reference tools, selectively extracting key data to build internal materials for Pharmacy and Therapeutics (P&T) committees and formulary planning.

The evidence:

11 and 28% of payers surveyed use pre- and post-approval dossiers, respectively, as primary sources of information. Furthermore, 83% of payers use pre-approval dossiers and 72% use post-approval dossiers as secondary sources of information. This reinforces that dossiers are not standalone decision tools but supporting resources.

Payers typically use manufacturer-provided dossiers to develop their own internal dossiers. This means they need to be able to quickly locate evidence of interest. Clear sectioning, concise summaries, and accessible references aren’t just nice-to-haves, they’re essential. These features help payers quickly locate relevant information and appropriate evidence to support access decisions.

Top tip:

Structure dossiers to support fast navigation. Use a clear table of contents, consistent formatting, and visual cues like headings and bullet points. Think about how a payer would search for data, then make it easy for them to find it.

“We use AMCP dossiers routinely in addition to other reports and journals… It is often referenced when creating a drug monograph and budget impact models.” – US payer in our 2025 survey

3. Ensure Dossiers are Timely and High Quality

Why it matters:

Timely and well-crafted dossiers can accelerate access and reduce the burden on P&T committees. Conversely, delays or poor-quality dossiers can lead to deprioritization or slower reviews.

The evidence:

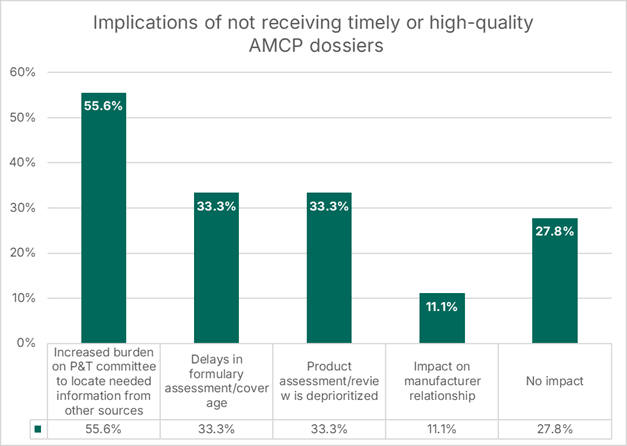

75% of payers said that delays or poor-quality dossiers negatively impact their review process, highlighting the following implications:

Most notably for manufacturers, one-third of participants stated that these shortcomings could lead to delays in formulary assessment or result in a product review being deprioritized.

“Being available for consumption in a timely manner is critical.” – US payer in our 2025 survey

Providing timely, high-quality dossiers helps reduce the burden on P&T committees and can accelerate time to access, reinforcing the importance of strategic dossier development and proactive engagement with payers.

Top tip:

Treat dossier development as a strategic priority. Build internal processes to ensure timely delivery, version control, and quality assurance. Consider aligning dossier readiness with pre-launch engagement timelines.

4. Engage Early, Especially Pre-Approval

Why it matters:

Early engagement allows payers to plan proactively, especially for high-cost therapies, rare diseases, or products expected to displace the standard of care.

The evidence:

While nearly 90% of payers rated post-approval dossiers as valuable, over 60% also saw value in pre-approval dossiers. Our survey also indicated that payers prefer engagement 6–12 months before launch, and in some cases up to 18 months before.

“These dossiers are useful for proactive planning, shaping the formulary strategy, and understanding the product’s positioning relative to competitors.” – US payer in our 2025 survey

With expanded guidance from the FDA around pre-approval information exchange (PIE), manufacturers now have greater flexibility to engage with payers ahead of product launch. Early engagement is particularly important for high-cost therapies, rare disease treatments, products entering competitive markets, or those expected to displace the standard of care. Early dialogue supports payers in proactive formulary planning to optimize access.

Top tip:

Don’t wait until approval. Use PIE and pre-approval dossiers to initiate early dialogue. This helps payers prepare internal materials, forecast budget impact, and assess clinical positioning.

5. Medtech, Diagnostics, and Devices need AMCP Dossiers too

Why it matters:

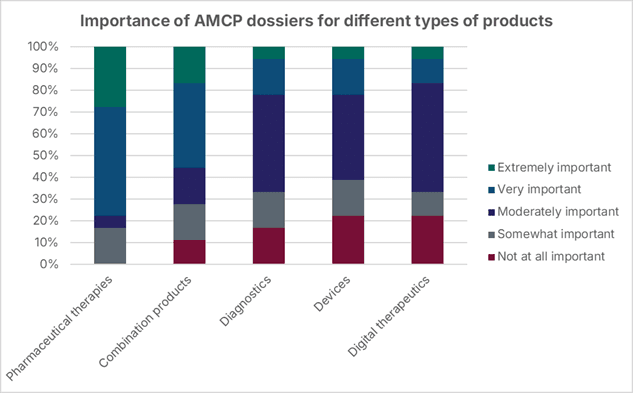

While AMCP dossiers are most critical for pharmaceuticals, payers also find value in dossiers for combination products, diagnostics, devices, and digital therapeutics.

The evidence:

More than half of the payers surveyed rated dossiers as at least moderately important across all product types. As expected, pharmaceuticals scored highest (average 3.9/5), followed by combination products (3.3/5), but diagnostics, devices, and digital therapeutics were also seen as relevant. This highlights that, even for non-traditional products, AMCP dossiers are a valuable source of information to support formulary decision making.

With the release of AMCP Format v5.0 in April 2024, manufacturers now have clearer guidance than before for presenting evidence across diverse product types. Leveraging this framework can help to drive relevant and impactful dossiers to suit the needs of payers with specific types of products. While the level and type of assessment by payers may differ between pharmaceuticals and devices, payers still heavily rely on manufacturer-provided information to inform their formulary assessment process.

Top tip:

Use AMCP Format v5.0 as the framework for your dossier. Even for non-traditional innovations, a well-structured dossier can support payer decision making and demonstrate value.

6. Build Trust in Economic Models and Evidence

Why it matters:

Economic models are an important part of the evidence base that payers expect to see in AMCP dossiers – particularly when assessing budget impact and formulary placement. However, payers are often skeptical of manufacturer-developed models due to concerns about bias, lack of transparency, and poor relevance to their populations.

The evidence:

Only a small proportion of payers reported high trust in manufacturer-developed health economic models. The most common reasons for low trust included lack of transparency, unclear assumptions, and models that appeared designed to justify high pricing.

Payers also emphasized the importance of transparency around data inputs, such as real-world data, trial data, and cost assumptions, as critical to building trust.

“It’s important that they cite the study and outcomes clearly. It’s also important that they list economic assumptions in their financial modeling.” – US payer in our 2025 survey

Top tip:

Ensure your economic models are transparent, well-documented, and grounded in credible data. Clearly explain assumptions, cite sources, and tailor inputs to payer-relevant populations. Where possible, include real-world evidence and offer interactive formats that allow payers to explore scenarios. Our in-house team of health economists can help you here. Based in the UK, they are highly experienced in building credible, transparent evidence-driven models that stand up to the highest level of scrutiny.

In Conclusion: Unlocking the Full Potential of AMCP Dossiers

With payer evidence needs evolving and the US access landscape growing more complex, manufacturers must take a strategic, forward-thinking approach to developing payer communication materials, including AMCP dossiers.

When thoughtfully developed, AMCP dossiers can serve as powerful tools for payer engagement and information sharing. Manufacturers who treat dossiers as strategic assets are better equipped to meet payer expectations, support informed decision making, and accelerate access in a competitive market.

At Petauri Evidence, we partner with clients to develop comprehensive suites of impactful payer communication materials for both pre- and post-launch phases, ensuring that every dossier is strategic, targeted, and resonates with payer audiences.

Whether you’re preparing for an upcoming launch or refining your market access strategy, connect with the Petauri Evidence team today to explore how we can help optimize your communication and engagement with key payer stakeholders. Email us today at evidence@petauri.com.

Share